Community Resources

Economic development incentives for property owners and developers on east side

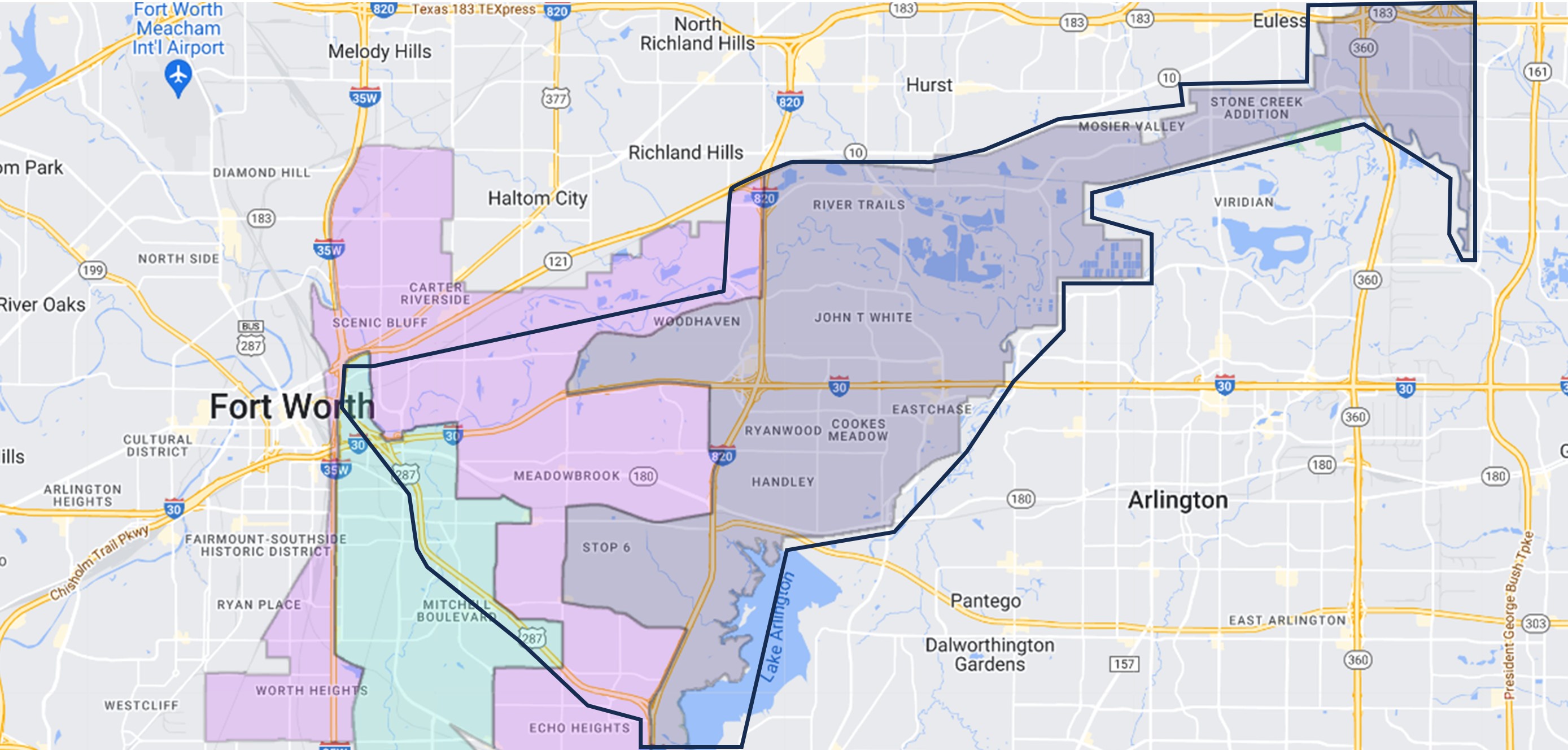

Neighborhood Empowerment Zone (NEZ)

Tax abatements and development and impact fee waivers for eligible Residential, Multi-Family, Commercial, Industrial, Community Facilities and Mixed-Use projects that fall within an NEZ. Most of East FW below Meadowbrook Dr. and above Mansfield Hwy is within a NEZ.

Façade Improvement Program

Reimbursement of $1 for every $3 spent up to $30,000 for eligible business or property owners located within an Urban Village or located along commercial corridors within one half mile of one of the three designated Urban Villages on East Lancaster.

Grants or Tax Abatement – Catalytic Development Incentive

Grant or tax abatement for projects located along East Lancaster (specifically, Designated Investment Zones, Revitalization Areas, and Urban Villages) that are Mixed-Use, create a hub of entrepreneurial activity, fill a gap in the neighborhood (such as a grocery store in food desert), and/or create significant job opportunities and commit to at least $5 million in investments.

Grant or Tax Abatement– Surface Parking Lot Redevelopment Incentive

Grant or tax abatement to develop current surface parking lots into commercial, mixed-use projects located along East Lancaster that support compatible businesses in the Central Business District and associated commercial corridors. In order to be considered for 380 Grants, a project must redevelop a surface parking lot in the Central Business District that occupies at least 30% of the area of the City block on which it is located. For developments that include multiple lots owned by unrelated parties, the grant amount increase to up to 45%.

Historic Site Tax Exemption

The Tax Exemption freezes the assessed valuations of the land and improvements at the pre-renovation tax values for the purpose of assessing city taxes. The exemption period is ten (10) years. Application to the Tarrant Appraisal District must be made each year of the exemption. Applications must be submitted prior to beginning the rehabilitation project. Eligibility for the Tax Exemption requires that an amount equal to or greater than 20% of the assessed valuation of the improvements be spent on rehabilitation. The Historic Site Tax Exemption (HSTE) involves a two-part process that requires approval by City of Fort Worth staff before the project is started, and final verification by the Landmarks Commission and the City Council upon completion of the project. The Tax Exemption will go into effect Jan. 1 of the year following City Council verification.